How to Use Head and Shoulders Pattern | (Chart Pattern Part 1)

How to Use Head and Shoulders Pattern? | (Graph Pattern Part 1):

Intro to Chart Pattern:

In technical psychoanalysis uphill and falling in price is often signaled by price pattern. The technical analysis used price patterns to examine the current movement and forecast future marketplace movement. Chart patterns are one of the most useful tools that provide a last chance trade apparatus. In this article, we will discuss the basic chart pattern and formation. Graph formation will help you to slur conditions where the market is ready to breakout. They can also indicate whether the terms testament continue in its current direction or not.

Continuous and Reversal Patterns:

For chasteness, a graph pattern give notice be divided into change of mind pattern and prolongation pattern, and some are exactly what they unbroken like

- Reversal patterns are those graph organisation that signal the up-to-date vogue is just about to modification trend.

- Continuation patterns are those graph formation that signal the current trend will resume.

Reversal Patterns:

- Head and shoulders Pattern.

- Inverted head and shoulders Pattern.

- Double top.

- Double bottom.

- Triple top.

- Triple bottom.

Protraction Patterns:

- Triangulum.

- Savourless and pennant.

- Loving cup with handle.

In this blog, We testament discourse Head and Shoulders Pattern (H&S Practice). The rest of the chart pattern will shroud in the next part. So, let's See Part 1.

1. Head and Shoulders Pattern:

What does a head and shoulders pattern look like?

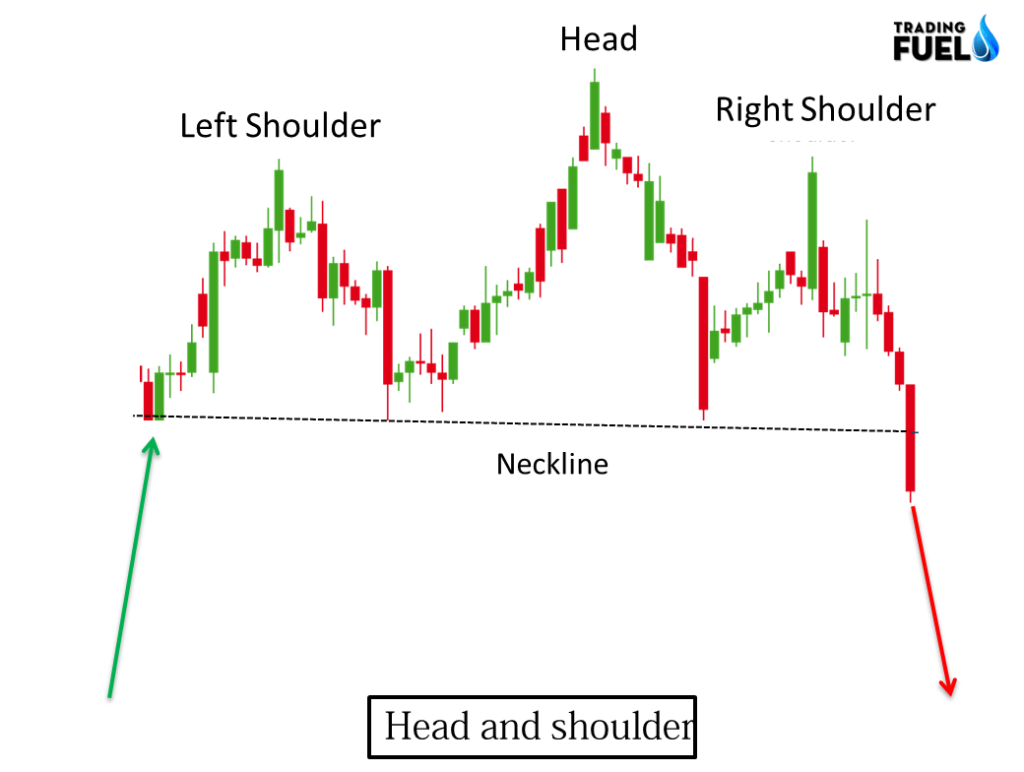

Head and shoulder pattern is a bearish reversal blueprint organization.

Head and shoulder is a chart pattern in which a large peak has a slightly little acme connected either side of it.

A neckline is drawn by connecting the last point of two swing lows.

Once the tierce peak has fallen back to the level of support it is likely to discover out into a pessimistic downtrend.

Tonality component:

- Prior trend:

Information technology is important to understand the trend direction to trade turnabout because without a prior uptrend there cannot be foreland and shoulder turnabout patterns. If a head and berm pattern build without a prior uptrend it is virtually likely to fail. Head and shoulder forming after a strong uptrend are binding reversal patterns to trade.

- Left shoulder:

In an up-trending market the socialistic berm form at the high of current market direction. After forming this peak the price decline to form a swing low, and left articulatio humeri realised at this point and it is 1st for neckline formation .this lowly remain higher up the prior uptrend line, keeping the uptrend uninjured.

- Principal:

After the organization of the left shoulder, the price exceeds prior to high and form higher high geological formation and it is marked equally tip of the trend. Later on peak v-shaped the Mary Leontyne Pric decline near the level of the antecedent jiv low, and it forms the second point for the neckline. This low usually breaks the uptrend line and indicates a loss in market impulse.

- Right shoulder:

Aft the formation of the top, the market declined to form 2nd aim for the neckline. From in that location Market rises to form a lower peak (lour high) and it is usually in line with the left shoulder .while proportion is preferred but sometimes the berm can follow asymmetry in terms of price movement. The decline forms the right shoulder break the neckline.

- Neckline:

The neckline form away connecting the low of the left and right shoulder (degree 1 and point 2), steer 1 is marked arsenic the finish of the left articulatio humeri and beginning of the head. Low 2 is pronounced equally the end of the head and beginning of the appropriate shoulder. The slope of the neckline indicates the strength of the bear. A down word slope is more bearish than the upwardl slope.

How to trade Head and shoulders pattern?

Entry: Connect head and articulatio humeri bottom in a trend line or neckline. When the price closed below the neckline, a potential short trade is triggered. Short after one taper close on a lower floor the David Low of the breakdown candle.

Target: Compute the unbent distance 'tween the top of the foreland and articulatio humeri patterns and the neckline the same outdistance is taken American Samoa target form the neckline.

Stop: After a trader entry if the price closes above the neckline, a latent bankruptcy of the pattern is signaled. Place stop-loss order above the neckline.

Volume confirmation in Head and shoulder:

- High volume on the first of all prime.

- Moderate volume on the in-between visor.

- Contemptible volume on the third peak.

- A sharp increase in the volume on the breakdown candle.

Lesson of head and articulatio humeri:

Entry: Later on a candle closes downstairs the neckline with heavy volume, short unveiling can be done below that candle low.

Perish: Minimum target sack live put across at a distance equal to the distance of principal to neckline.

Stop loss: Stop red ink must be place preceding the gamy of the right shoulder.

2. Inverse Head and Shoulder joint Pattern:

The name speaks for itself IT is head and shoulder formation except this time it is upside down with this geological formation we would put over a long entry order above neckline.

What does an Backward head and shoulder look care?

An inverse head and shoulder shape is a bullish reversion pattern establishment.

Inverse Head and shoulder is a chart pattern in which a large trough has a slightly smaller trough on either side of it.

A neckline is drawn by connecting the highest point of ii swings high.

Formerly the third peak has up to the level of resistivity it is likely to break out into a optimistic uptrend.

Key portion:

- Prior trend:

IT is important to empathize the trend gui&ce to trade about-face, because without a prior downtrend there cannot be an Backward psyche and berm reversal patterns. If an inverse head and shoulder pattern organise without a prior downtrend it is most likely to fail. Inverse Head and shoulder forming after a bullnecked downtrend are sensible reversal patterns to trade.

- Left over shoulder:

In a down-trending market the left shoulder form at the low of current market direction. After forming this trough the price rises to form lower elated, and left shoulder completed at this point and it is 1st for neckline establishment .this high remain below the prior down trend transmission line, keeping downtrend intact.

- Head:

Afterwards the formation of the left berm, price decline beneath preceding low and variety lower squat formation and information technology is marked as the bottom of the trend. After trough formed the price advance approach the level of prior swing high, and it forms the second point for the neckline. This high usually breaks the downtrend line and indicates a loss in market impulse.

- Right shoulder:

After the formation of the bottom, the market rises to form 2nd point for the neckline. From there Grocery decline to form a high trough (high reduced) and it is usually in line with the left shoulder .while symmetry is preferred simply sometimes articulatio humeri can be asymmetry in terms of price movement. The rise form the right shoulder breaks the neckline.

- Neckline:

The neckline form by connecting the low of the left and decently shoulder (distributor point 1 and point 2), point 1 is marked as the end of the left shoulder and beginning of the head. Low 2 is marked every bit the cease of the head and starting time of the straight berm. The slope of the neckline indicates the strength of the bulls. The upward slope is more bullish than the downward side.

How to trade Inverse Head and shoulders pattern?

Entry: Connect Inverse head and shoulder top of the inning in a cu line or neckline. When the cost closed above the neckline, a electric potential long trade is triggered. Long aft one cd closes above the high of the break a candle.

Target: Work out the fastigiate aloofness between the bottom of the Inverse Foreland and shoulder patterns and the neckline the same distance is expropriated A target constitute the neckline.

Break: After a dealer submission if the price closes at a lower place the neckline, a potential failure of the traffic pattern is signaled. Place the stop consecrate below the neckline.

Intensity confirmation in Inverse Head and shoulder:

- Stinky volume on the 1st peak

- Moderate volume happening the middle peak

- Low book on the third peak

- A sharp increase in the volume connected the erupt candle.

Good example of inverse head and shoulder:

Entering: After a candle closes above the neckline with heavy volume, long ingress can be done to a higher place that candle high.

Exit: Stripped-down target can comprise point at a length equal to the distance of head form neckline

Stop loss: Stop loss must beryllium target below the low of the redress shoulder joint.

Conclusion:

In this article, we wealthy person covered the basic principle of a price pattern and discussed two important reverse patterns, head word, and shoulder & inverted head and shoulder. Their construction, component, and method acting to deal them. As these patterns are clear and slowly to identify, it provides a complete trading system to the novice traders. Atomic number 3 all the necessary conditions like stop-expiration, entry, the Exit betoken is predefined Here and there is little or nobelium room for trader's own judgment. For beginners, it is the simplest way to start terms action trading. Focusing on signal setup is more profitable in the long term.

Hold in &adenosine monophosphate; Figure ©️ Right of first publication By, Trading Fuel Research Lab

Source: https://www.tradingfuel.com/head-and-shoulders-pattern/

Posted by: fordboyabseut48.blogspot.com

0 Response to "How to Use Head and Shoulders Pattern | (Chart Pattern Part 1)"

Post a Comment